An expense is something that has been purchased or paid for that can be offset against taxable income.

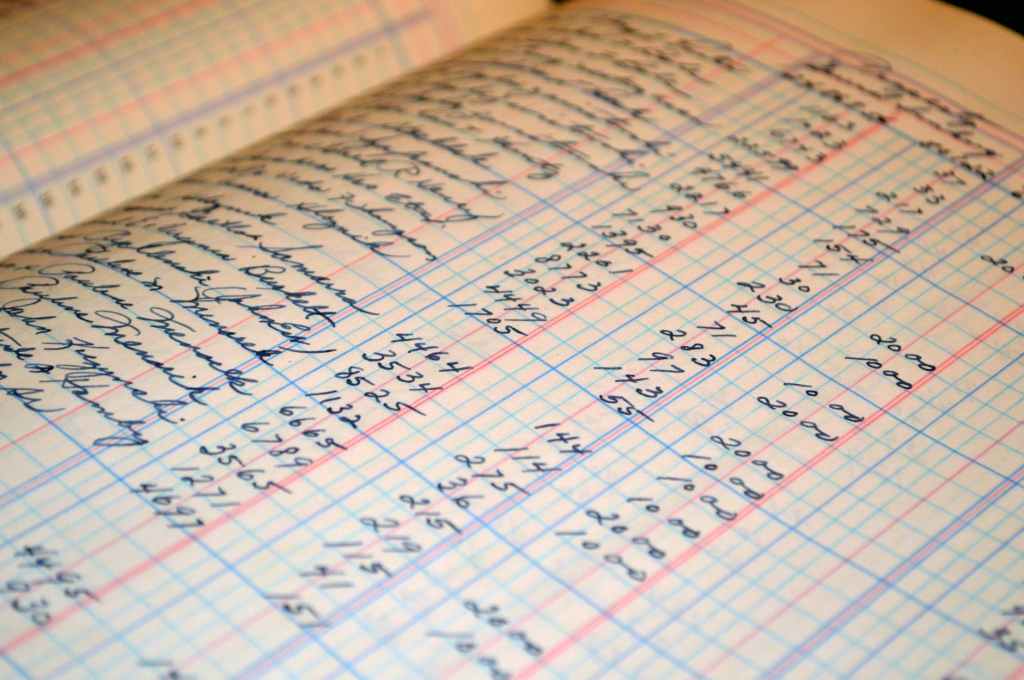

Income & expenses are what makes up our financial records.

The word ‘Expenses’ can be used as a general term for all outgoings. It is however helpful to split expenses into a couple or multiple categories.

As a minimum, expenses should be split into expenses related to operating expenses/overheads, and expenses related directly to sales, more formally known as ‘cost of goods sold’ or COGS for short.

Cost of Goods Sold – Direct Expenses, a few examples could be:

- Purchases

- Materials & Supplies

- Cost of turning materials into finished product

- Direct labour costs

Sales – Cost of goods sold = Gross Profit

Gross Profit is used to establish how much money is made on each sale. This figure is then used to cover business operating expenses.

Operating Expenses – Indirect Expenses, Costs that might be included:

- Rent & rates

- Utilities

- Insurance & licences

- Financial costs

- Administrative costs

Once operating expenses are calculated, this is deducted from gross profit to give net profit for a given period.

Income – All Expenses = Net profit. This is the money left as PROFIT. For sole traders this is the income that is taxable.

Having an understanding of the expenses that are required to produce sales is important as it helps to guide how to price products and services.

In order to budget effectively, it is helpful to have an estimate of what business operating expenses might be and when they are due for payment.

Reach out to a Bookkeeper or an Accountant if unsure of what counts as business expenses or how to budget effectively.

We are here to support you and your business.

Accounting for all business expenses will ensure business owners only pay the amount of tax due and not a penny more.